eBay, Paypal, and Stripe Fee and Profit Calculator

Use our online calculator to calculate merchant transactional fees for eBay, Paypal, and Stripe. Don’t hesitate to leave us feedback how to Improve it our online calculator or any suggestions you would like us to add itMore About Your eBay Fees

Via ebay.com

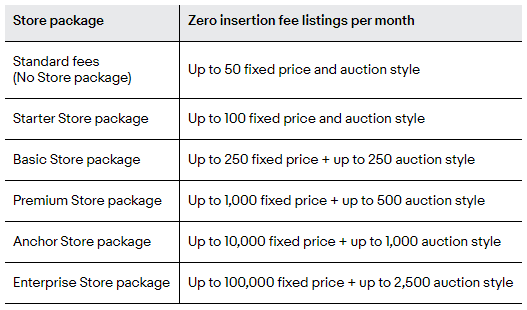

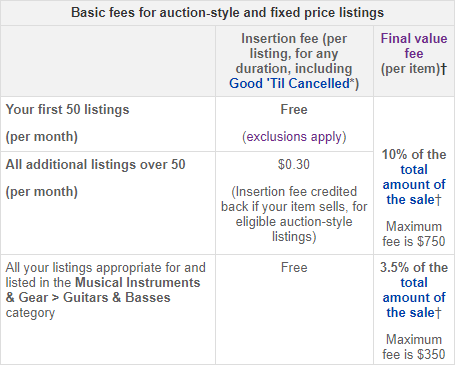

Once your free listings are used up, an insertion fee of $.35 per item will apply. Points to note about insertion fees:

-

Insertion fees are charged per category and per listing. Therefore, if you list an item in two categories, you’ll pay an insertion fee for both categories

-

Insertion fees are not refundable even if your item doesn’t sell

-

If you create duplicate auction-style listings for similar items, insertion fees are charged per listing

-

They are charged each time you decide to relist an item as well as for the original listing

-

Are charged only once per insertion for listings with lots of items.

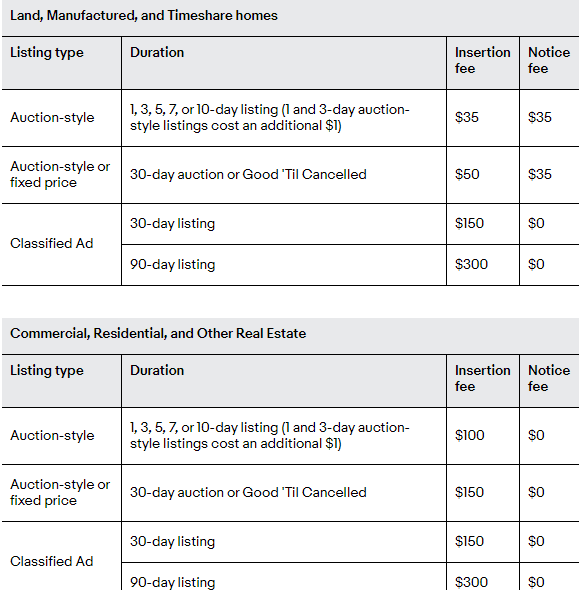

For a 30-day Classified Ads listing, you need to pay a fee of $9.95 and no final value fees.

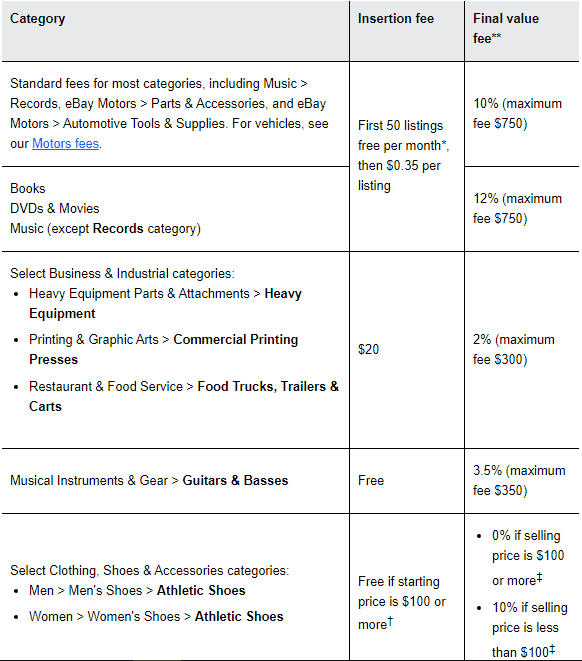

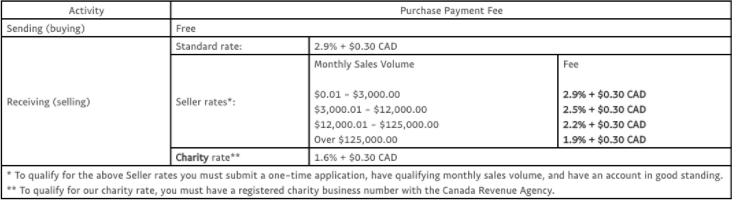

When your item sells on eBay, a final value fee, calculated as a percentage of the total amount of the sale (including handling and shipping charges), is charged. If you’re using PayPal as your payment method an eBay and PayPal Calculator can help you determine the total amount of charges that will apply.

If you’re using PayPal as your mode of payment, a charge of 2.9% of the total sale amount plus $0.30 will apply. On the other hand, if you are using any other type of payment a charge of 2.7% of the total amount plus $0.25 will apply.

If you’re using PayPal as your mode of payment, a charge of 2.9% of the total sale amount plus $0.30 will apply. On the other hand, if you are using any other type of payment a charge of 2.7% of the total amount plus $0.25 will apply.

Image via ebay.com

Amazon charges a final value fee of 15% while eBay charges 10%. When compared to Amazon, the only extra fee that eBay charges is the PayPal fee which is 2.9% of the sale plus a fixed rate of $0.30. An eBay and PayPal calculator is helpful at determining how much fee you should pay.

In terms of profit, a seller on eBay gets to keep an average of 5.13% more than if they sold on Amazon. However, it is important to keep in mind that on eBay, sellers are left to handle distribution, shipping, storage, and packaging on their own, while Amazon takes care of all these processes for their sellers.

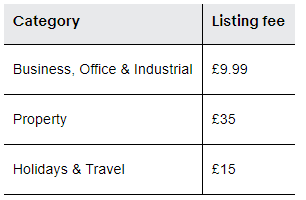

Private sellers have up to 1,000 free monthly listings, or more if they have an eBay shop, but once they’ve used up their free listings they are charged 35p for each new listing they create. For Business sellers, the fees are a bit different, you can learn more about them here.

If the buyer fails to pay for your item(s) for whatever reason, you need to either report the transaction as unpaid or cancel the sale for you to be eligible for a final value fee credit.

More About Your PayPal Invoice Fees

Image: PayPal.com

Image: PayPal.com

Image: PayPal.com

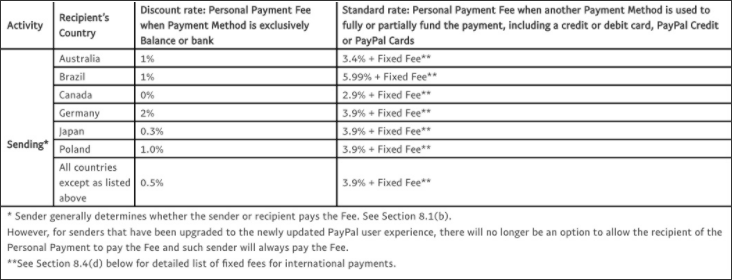

From the table, you can see that the international standard rates vary from country to country. For instance, Canada has a 2.9% fixed fee that is similar to that of the U.S. while a 5.99% fixed fee applies to Brazill.

With the exception of Australia which has a 3.4% fixed fee, all other countries have a 3.9% fixed rate fee in place. When sending money, the sender is responsible for paying the fee.

When receiving international payments within the U.S. a 1% charge of the payment amount will be applied when you use your PayPal or Bank account. However, when you use your credit or debit card, a 3.9% fee of the payment amount plus a fixed fee, depending on the currency of the payment, will be charged.

Image: PayPal.com

From the table, you can see that the international standard rates vary from country to country. For instance, Canada has a 2.9% fixed fee that is similar to that of the U.S. while a 5.99% fixed fee applies to Brazill.

With the exception of Australia which has a 3.4% fixed fee, all other countries have a 3.9% fixed rate fee in place. When sending money, the sender is responsible for paying the fee.

When receiving international payments within the U.S. a 1% charge of the payment amount will be applied when you use your PayPal or Bank account. However, when you use your credit or debit card, a 3.9% fee of the payment amount plus a fixed fee, depending on the currency of the payment, will be charged.

Image: eBay.com

Image: eBay.com

More About Your Stripe Invoice Fees

For all eCommerce transactions, Stripe charges 2.9% of the total transaction amount plus $0.30 per transaction regardless of whether you are using Mastercard, Visa, JCB, or any other card.

This fee applies whether you are using a third-party shopping cart or your own site. Using a stripe processing fee calculator is a good way to determine the amount of fee you’ll be charged.

If transactions are made using international cards, an additional 1% fee is applied, but if you need to convert the currency, an additional 1% fee is charged. Stripe’s instant payout option also carries a 1% fee.

Stripe also allows you to manage ACH and other payment options such as wire transfer. Charges are as follows:

-

Wire: $8.00 per wire payment

-

ACH Direct Debit: 0.8% per transaction (capped at $5)

-

ACH Credit: Starting at $1.00 per ACH credit payment

If you need to verify your customer’s bank accounts, no extra fee is charged. However, a $15 fee is applied for disputed ACH direct debit payments and $4 for failed ACH direct deposit payments.

Both Stripe and PayPal offer a standard transaction fee of 2.9% + $0.30 and there are no monthly fees, contracts, or setup costs for both. However, PayPal sales volume fees reduce at $3,000 sales per month while those of Stripe get reduced at $80,000 per month.

You can use an online PayPal or Stripe processing fee calculator to calculate how much fees you’ll be charged for the same amount using both platforms.

If you are looking for a developer-friendly online payment platform, Stripe is the best option and offers far more payment options for customers. On the other hand, if you are looking for improved in-person payment options and an easy eCommerce store integration, Square is the best choice or wordpress

No fees are charged during a Stripe refund, however, you’ll not get back the processing fees from the original transaction. Refunds can be returned in whole or in part. Also keep in mind that if the original charge was converted to a different currency, the refunded amount will also be converted back using the same process.

No, Stripe is not owned by PayPal. Stripe is a privately owned company founded in 2010 by Irish entrepreneur brothers John and Patrick Collison and based in San Francisco, California.